Desire Over Speculation: Rethinking How Art Is Bought Now

How younger collectors, shifting wealth, and changing values are reshaping the art market

By Jillian Goss-Holmes

Frida Kahlo, El sueño (La cama), 1940. Photo Courtesy: Sotheby's.

As this year drifts to a close, the art world unfurls into its end-of-year frenzy. With the Frieze Fairs in London, the Venice Architecture Biennale, New York Auction Week, and Miami Art Week all unfolding in quick succession, the convergence of these art-adjacent ecosystems becomes a kind of global petri dish. Each year gives us new data points where the industry examines itself, tests its assumptions, and teases out early findings for 2025 while sketching predictions for the year ahead. Beneath the familiar frenzy, however, lies something more structural and transformative than any single Sotheby’s headline sale or viral Jeff Koons moment.

What has become undeniably visible this year is the presence, and ultimately power, of a previously labeled emerging and incoming generation of collectors. Though ‘emerging’ and ‘incoming’ were once appropriate descriptors, the adjectives now undersell what is happening. They are no longer incoming; they are here. And they are changing the art market.

According to The Art Basel and UBS Survey of Global Collecting 2025, nearly three-quarters of active collectors surveyed belong to the Millennial (55%) and Gen Z (19%) brackets. Gen X accounted for most of the remaining quarter, while Baby Boomers, historically the backbone of the market, represented just 1%. Compare this to earlier surveys, where Baby Boomers held up to 20% of the collector pool, and the shift becomes undeniable. The dramatic shift in generational collecting is not a gradual slope, but rather a demographic cliff.

Of course, generational demographics alone do not paint the entire picture. What matters most for galleries, advisors, and the art market at large is that their motivations, preferences, and habits differ from their previous cohort in ways that reshape how art is discovered, purchased, and valued.

Consider the continued normalization of online transactions. Across all generations, digital platforms are now fully assimilated into collecting behaviors, but younger buyers lean into them with an innate capacity that has made ‘online-first’ a reality. Artsy’s 2024 Collector Insights report found that 82% of younger collectors have bought art online, compared to 77% of older cohorts. That gap may seem small, but the difference emerges more starkly in how they use digital platforms: 47% of younger collectors discover and purchase works through online marketplaces, compared to 43% of older cohorts. For them, digital discovery is not an in-person replacement but rather an extension of their research database. The pandemic may have accelerated the shift online, but 2025 proves it is no longer a temporary adjustment; it is rather the new baseline of a hybrid marketplace in which speed, transparency, and access can complement seeing art physically.

Still, beneath the optimism surrounding digital fluency and expanded reach, an uncertainty persists, particularly among galleries navigating this shift in real time. While working with a Washington, D.C.-based gallery on a recent project, one of the gallery’s directors voiced a concern echoed across the industry: whether online visibility and engagement can meaningfully translate into sustained purchases and committed collectors. While likes, shares, and saves, she noted, can feel good (albeit superficially) conversions remain less predictable. In an effort to bridge that gap, the gallery ultimately made the decision to list prices directly within its online catalogue — a move that speaks to both the growing pressure for transparency and push to accommodate the online lurkers. The question is no longer whether collectors are looking virtually but whether visibility alone is enough to foster the long-term relationships that galleries rely on. The art ecosystem’s hesitation does not signal resistance so much as adaptation; a market learning how to measure value in an attention-economy, fueled by younger generations, without mistaking attention for commitment.

Detail of a work by Desmond Beach, presented by Richard Beavers Gallery, SCOPE, 2025. Photo Courtesy: Jillian Goss-Holmes.

Layered on top of these behavioral differences is the looming ‘Great Wealth Transfer,’ a ubiquitously discussed but arguably underappreciated economic force that will funnel trillions from Baby Boomers to younger generations over the coming decades. According to The Art Basel and UBS Survey of Global Collecting 2025, Baby Boomers still controlled 51% of U.S. household wealth, compared to just 10% held by millennials and Gen Z. But this generational split is only temporary as some of this wealth transfers to younger generations over the next handful of decades. And as wealth begins to shift, so too will the cultural and economic influence of younger buyers, particularly women, who are projected to become one of the most significant wealth-holding groups of the next half-century as per The Art Basel and UBS Survey of Global Collecting 2025. So what are these younger, and soon-to-be very wealthy, collectors eyeing and buying?

Reports show that Gen Z collectors made the most transactions of any demographic in 2024, even if their total spending was below that of established collectors. Gen Z collectors gravitate toward works in the $5–10K range (40%), while Millennials skew slightly lower, with 38% purchasing under $5K. This reinforces the widespread perception that younger collectors enter the market through emerging and mid-career artists rather than blue-chip categories — a trend that could be quite meaningful for the future of young artists’ careers, market formation, and gallery ecosystems. Gen Z and Millennials were also the most active in discovering new artists: 71% of Millennial collectors and 63% of Gen Z collectors purchased a newly discovered artist in 2024. Baby Boomers, by contrast, landed at 46%.

This shift toward discovery- and values-driven collecting was echoed beyond the buyer base itself. At Art Basel Miami Beach, during the panel Conversations: Building the Future of the Art World, a curator on the panel emphasized that his own collecting priorities are rooted not in speculation or trend, but in works that carry meaning — pieces which resonate in connection, identity, and lived experience. In this context, emerging collectors’ gravitation towards emerging artists, whose work reflects personal and collective narratives, feels like an alignment with where curatorial and institutional thinking is already heading.

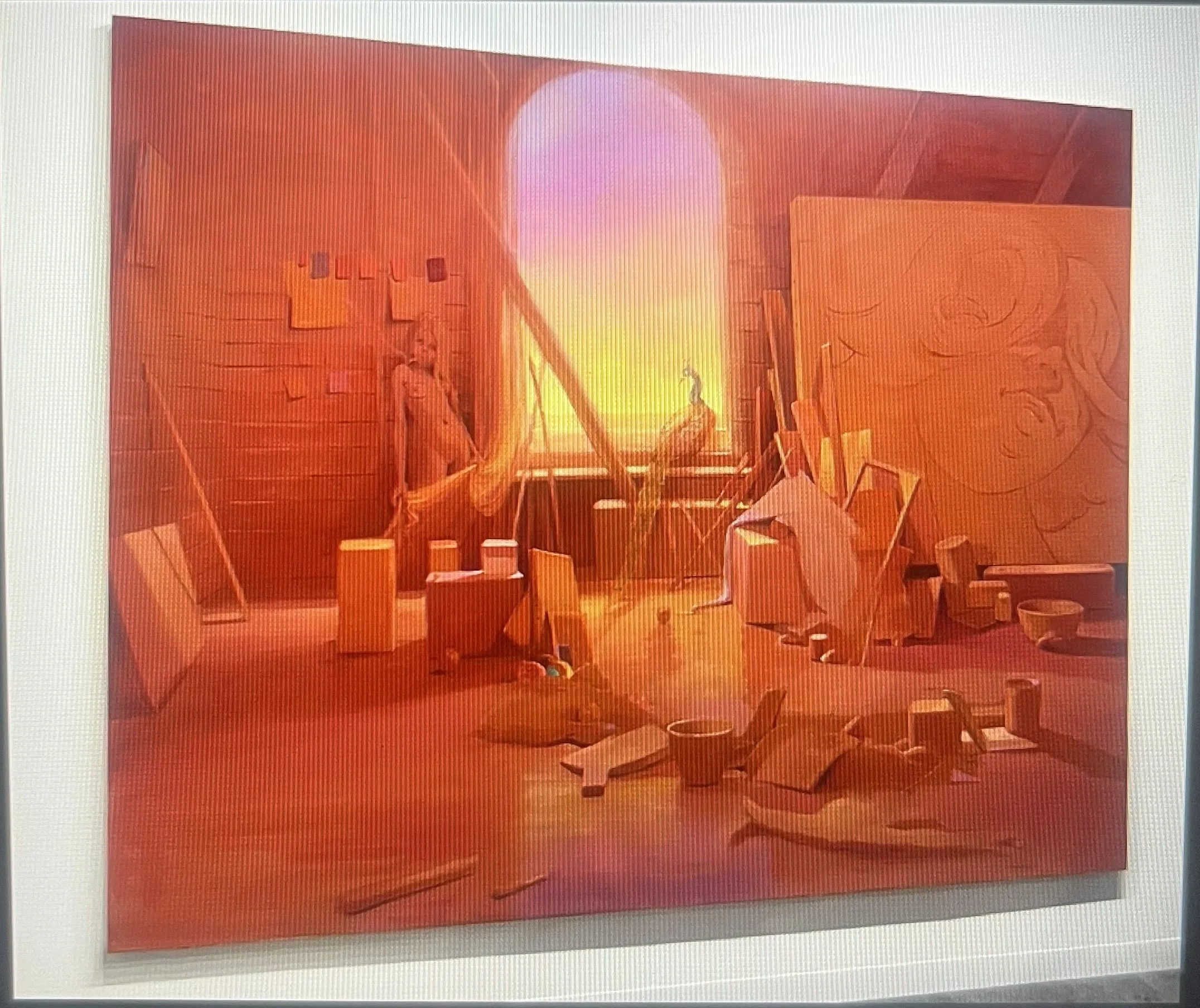

Details of a work by Lisa Yuskavage, presented by David Zwirner Gallery, Art Basel in Miami Beach, 2025. Photo Courtesy: Jillian Goss-Holmes.

On the other side of the spectrum, more established collectors made fewer purchases but tended to gravitate toward blue-chip works. Baby Boomers’ collections averaged 62% established artists; Gen Z sat at 44%. Female Baby Boomers made more transactions than men and were as active as younger collectors in several segments, reflecting a trend increasingly echoed across fairs: women collectors are emerging as one of the most influential forces in shaping contemporary market dynamics. Matthew Newton, Head of UBS Art Advisory for the Americas, recently reinforced these findings, commenting ‘the art market is more dynamic and open-minded than it’s been in years.’ Adding ‘we’re seeing a noticeable demographic shift of collectors dominating the market, especially among women and Gen Z, whose diverse tastes span a wider range of mediums and formats beyond the traditional.

Perhaps unsurprisingly, Gen Z was also the cohort most likely to seek advice from artists themselves and from AI tools when deciding what to buy. Meanwhile, older collectors relied more heavily on advisors and longstanding professional relationships. Though methods may differ, there is a universal desire to make informed decisions. But data can only capture so much. To understand why collectors move the way they do, you have to listen to them.

Detail of work by Death by Narhwals, Umbrella Art Fair, 2025. Photo Courtesy: Jillian Goss-Holmes.

At a recent collector panel hosted at the Umbrella Art Fair in Washington, D.C., Collector's Stage: Creating Value and Legacy, the conversation drifted naturally into these generational differences. One panelist spoke about collecting as a way to ‘bring micro-communities together,’ describing the genuine pleasure in connecting artists, curators, and friends of all ages and backgrounds through shared encounters within the ecosystem. It was a sentiment that felt distinctly reflective of collecting culture, where art is treated as a site of exchange, not accumulation.

But the line that lingered longest belonged to a younger panelist who articulated what many feel but rarely say in market-facing contexts: ‘I don’t buy art because I expect to make money out of it. I buy art because I love the art. It feels like it’s a piece of me — even if it’s from you.”

It was a reminder that desire, rather than speculation, still moves the market. And perhaps this is where younger collectors most radically depart from the narratives often projected onto them. For all their digital fluency and appetite for discovery, their purchases are remarkably personal. They buy based on identity, belief, and curiosity.

As these new collectors continue to define, and redefine, their tastes, practices, and priorities, the market will evolve around them, as it always has. But 2025 suggests that the evolution ahead will be less about volatility and more about widening the pathways into collecting: more accessible price points, more transparent channels, more local engagement, more varied motivations, more diverse collectors shaping the conversation. And the market, perhaps, seems ready to embrace that plurality rather than resist it.

Bibliography:

Art Basel. ‘Emerging from the Shadows, Gen X Are Now the Biggest Spenders.’ Art Basel. https://www.artbasel.com/stories/gen-x-art-market-collectors-biggest-spenders-sandwich-generation.

Artsy. ‘Artsy Collector Insights Report 2023.’ Artsy. https://pages.artsy.net/rs/609-FDY-207/images/Artsy_Collector%20Insights%20Report%202023.pdf.

McAndrew, Dr. Clare, ‘The Art Basel & UBS Survey of Global Collecting 2025.’ Arts Basel, UBS. https://theartmarket.artbasel.com/download/The-Art-Basel-and-UBS-Survey-of-Global-Collecting-in-2025.pdf.

Kakar, Arun. ‘Art Collector Insights 2024.’ Artsy. https://www.artsy.net/article/artsy-editorial-art-collector-insights-2024.

Schulz, Madeleine. ‘Art Basel Miami 2025 Cheat Sheet.’ Vogue Business. https://www.vogue.com/article/art-basel-miami-2025-cheat-sheet.